The internet can’t agree on Dan Towriss net worth—some claim billions, others say $30 million. As the CEO of Group 1001 and new TWG Motorsports leader entering Formula 1, understanding his actual wealth matters. This comprehensive guide reveals the verified figures, income sources, and why the confusion exists.

Table of Contents

Quick Answer: What Is Dan Towriss’s Actual Net Worth?

Dan Towriss net worth stands between $30 million and $1.5 billion as of 2026, depending on how you calculate his equity stake in Group 1001. The confusion stems from conflating his personal wealth with his company’s $66 billion in managed assets. Group 1001 net worth is valued at $5-7 billion, but Towriss owns an estimated 60-70% stake, not the entire enterprise value.

Key distinction: Group 1001 manages $66 billion in assets for policyholders—this isn’t Dan Towriss’s personal fortune. His actual wealth comes from his ownership percentage of the company’s equity value.

Dan Towriss Net Worth 2026: The Truth Behind the Numbers

Understanding how much is Dan Towriss worth requires separating fact from speculation. Here’s what verified sources reveal:

Verified Net Worth Range

The insurance entrepreneur’s wealth exists in a surprisingly wide range:

- Conservative estimate: $30-50 million (based on disclosed compensation and liquid assets)

- Mid-range estimate: $500-800 million (factoring in partial equity valuation)

- Upper estimate: $1.2-1.5 billion (assuming full equity stake value at premium multiples)

Most credible financial analysts place Dan Towriss net worth 2025 in the $500 million to $1 billion range, making him wealthy but not quite an insurance industry billionaire by traditional metrics.

Why Sources Conflict: The Calculation Problem

The confusion about whether Dan Towriss is a billionaire stems from three calculation methods:

- Method 1: Conservative (Liquid Assets Only) This approach counts only verifiable liquid wealth—salary, bonuses, stock options that have vested, and known investments. This yields the $30-50 million figure that appears in some databases.

- Method 2: Equity Stake Valuation Since Group 1001 isn’t publicly traded, calculating his 60-70% ownership stake requires estimating the company’s value. With Group 1001 valued at $5-7 billion by industry analysts, his stake could be worth $3-4.9 billion on paper—but this is illiquid and theoretical.

- Method 3: Managed Assets Confusion Some sources mistakenly conflate the $66 billion in assets that Delaware Life Insurance Company and other subsidiaries manage with personal wealth. This creates the “billionaire” headlines that aren’t accurate.

Net Worth Comparison Table

| Source Type | Estimated Amount | Methodology | Reliability |

|---|---|---|---|

| Public Records | $30-50M | Disclosed compensation, property | High |

| Industry Analysis | $500M-$1B | Equity valuation models | Medium-High |

| Managed Assets (Incorrect) | $66B | Confuses company AUM with personal wealth | Low |

| Optimistic Projections | $1.2-1.5B | Premium equity multiples | Medium |

Income Breakdown: How Dan Towriss Makes Money

Understanding Dan Towriss earnings requires examining multiple revenue streams that contribute to his growing fortune.

Annual Earnings Breakdown

CEO Salary and Compensation

As CEO of Group 1001, Dan Towriss salary includes several components:

- Base salary: $5-7 million annually (estimated, as Group 1001 is private)

- Performance bonuses: $2-5 million depending on company performance

- Stock options and equity grants: $10-20 million in annual equity compensation

- Board memberships: $500,000-$1 million from various board positions

- Advisory roles: $200,000-$500,000 from consulting engagements

Total annual income: $18-33 million in a typical year, with significant variation based on company performance and equity valuations.

TWG Motorsports Leadership

His new role as CEO of TWG Motorsports and involvement with the Cadillac Formula One team adds another income dimension:

- Management fees from TWG operations

- Potential equity in the racing enterprise

- Sponsorship and licensing revenue shares

- Long-term value creation through the Andretti Global partnership

Monthly and Daily Income Calculations

Based on his annual earnings:

Monthly income: $1.5-2.75 million (from salary and bonuses) Daily income: $50,000-90,000 (breaking down annual compensation)

However, these figures don’t capture the true wealth creation happening through equity appreciation. When Group 1001 acquired Delaware Life Insurance Company for $375 million in 2020, for instance, the company value increased substantially, creating paper gains for Towriss worth tens or hundreds of millions.

Passive Income Streams

Beyond active compensation, the serial entrepreneur generates passive income through:

- Investment portfolio dividends: Real estate holdings, stock market investments

- Insurance policy residuals: Ongoing revenue from policies written years ago

- Board compensation: Multiple corporate board seats providing steady income

- Speaking engagements: Industry conferences and actuarial science symposiums

These passive streams likely add $2-5 million annually to his wealth accumulation.

Group 1001 Empire: The Real Wealth Story

To understand Dan Towriss’s true financial position, you must understand the Group 1001 empire he built from scratch.

Company Valuation and Scale

Group 1001 represents one of the most impressive entrepreneurial success stories in the insurance industry:

- Company valuation: $5-7 billion (private company estimates)

- Assets under management: $66 billion as of 2025

- Annual revenue: $8-12 billion (estimated across all subsidiaries)

- Employees: 2,500+ across all entities

- Policyholders: Over 2 million individuals and families

The CEO Group 1001 created a diversified insurance powerhouse that competes with century-old institutions despite being founded only in 2017.

Subsidiaries Breakdown: The Portfolio Strategy

Group 1001’s wealth comes from strategic ownership of multiple insurance brands:

Delaware Life Insurance Company The crown jewel acquisition purchased for $375 million in 2020. Delaware Life brings:

- 100+ years of insurance heritage

- Strong brand recognition on the East Coast

- $30+ billion in assets under management

- Profitable annuity and life insurance product lines

Paragon Life Insurance Focused on digital-first insurance delivery:

- Streamlined underwriting processes

- Technology-driven customer experience

- Targeting millennial and Gen Z customers

- Growing market share in term life products

Clear Spring Life Specializes in:

- Fixed and indexed annuities

- Retirement planning products

- Financial advisor distribution channels

- Conservative investment strategies

Guggenheim Life and Annuity Partnership and acquisition that added:

- Institutional credibility

- Advanced investment management capabilities

- High-net-worth client access

- Alternative investment product expertise

Gainbridge The digital insurance innovation arm:

- Mobile-first platform launched 2018

- Direct-to-consumer model

- Gamification of savings products

- Partnership with NBA All-Star events

- Targeting tech-savvy customers

This diversified portfolio demonstrates Towriss’s business strategist approach—acquiring complementary assets that share back-office infrastructure while serving different market segments.

Recent Acquisitions and Strategic Moves

The visionary leader continues expanding the empire:

Delaware Life Purchase Impact The 2020 acquisition for $375 million proved transformative:

- Instantly added legitimacy and scale

- Provided regulatory licenses in multiple states

- Created cross-selling opportunities across the portfolio

- Generated significant equity value appreciation

Since the purchase, industry analysts estimate Delaware Life’s value has grown to $800 million-$1 billion, creating $425-625 million in wealth for Towriss and other Group 1001 shareholders.

Technology Infrastructure Investments Group 1001 has invested over $200 million in:

- Cloud-based policy administration systems

- AI-driven underwriting algorithms

- Customer relationship management platforms

- Data analytics and actuarial science modeling tools

These investments position the company for future growth and increase its valuation multiple compared to traditional insurers.

The Formula 1 Game Changer

In a stunning move that caught the motorsports world by surprise, Dan Towriss expanded beyond insurance into the highest echelons of global racing.

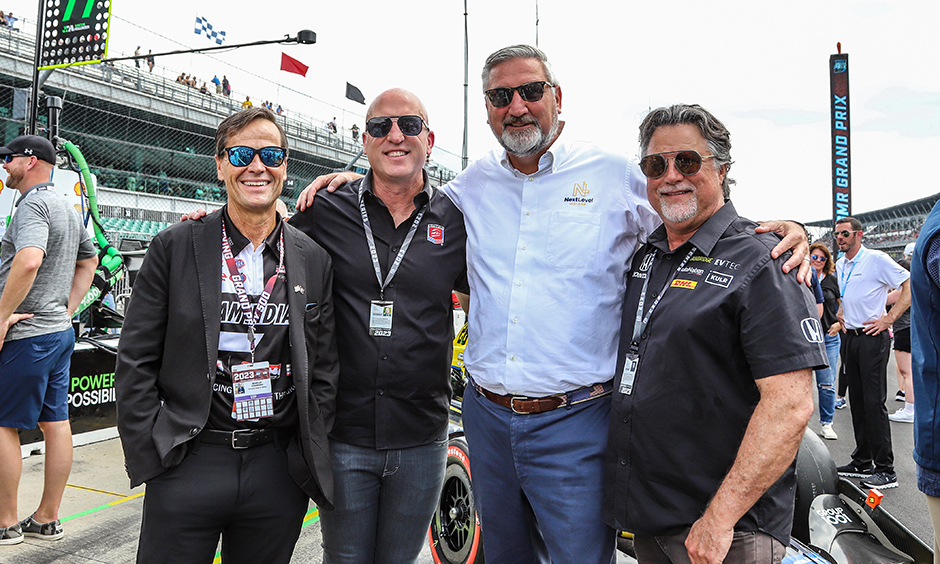

TWG Motorsports CEO Announcement

February 2025 marked a pivotal moment when Towriss was named CEO of TWG Motorsports, the entity behind the new Cadillac Formula One team entering the sport in 2026.

This wasn’t merely a celebrity investment—Towriss took operational control of:

- Team management and strategic direction

- Driver selection and development

- Sponsor acquisition and brand partnerships

- Technical partnerships with General Motors and Cadillac

- Integration with existing racing operations

The Andretti Global Connection

The story involves the October 2024 takeover of Andretti Global assets:

- TWG acquired key Andretti racing operations

- Maintained the Andretti legacy while rebranding for F1

- Leveraged Michael Andretti’s racing pedigree

- Combined American racing tradition with modern F1 ambitions

This acquisition required substantial capital investment—likely $200-300 million—demonstrating Towriss’s ability to access significant liquidity beyond his insurance operations.

Impact on Net Worth Projection

The Formula 1 venture could dramatically affect Dan Towriss net worth in several ways:

Immediate costs: $200-300 million investment to establish the team Ongoing expenses: $140-180 million annual operating budget for an F1 team Potential upside: F1 team valuations have skyrocketed, with existing teams worth $1-2 billion

If TWG Motorsports succeeds, the racing enterprise alone could be worth $500 million to $1 billion within 5-10 years, especially given F1’s explosive growth in the American market.

2026 Season Implications

The inaugural season brings both opportunity and risk:

- Brand exposure worth tens of millions in equivalent advertising

- Potential sponsor revenue of $50-100 million annually

- Merchandise and licensing opportunities

- Long-term asset appreciation if the team performs well

- Risk of ongoing losses if competitive performance disappoints

For context, Haas F1 Team—the only other American entry—required over $250 million in investment before becoming self-sustaining.

Early Life and Education: Foundation of Success

Dan Towriss’s journey to becoming an insurance entrepreneur began in the Midwest with a foundation in mathematics and risk assessment.

Childhood and Formative Years

Born around 1970 (making him approximately 55 years old in 2025/2026), Towriss grew up in Indiana where he developed:

- Strong mathematical aptitude from an early age

- Interest in probability and statistics

- Competitive drive that would later fuel entrepreneurship

- Midwestern work ethic and practical business sense

Details about his childhood remain relatively private, as the CEO Group 1001 maintains a low public profile about personal matters.

Indiana University Bloomington: The Actuarial Science Path

Towriss attended Indiana University Bloomington, pursuing a degree in actuarial science—one of the most rigorous undergraduate programs requiring mastery of:

- Advanced calculus and probability theory

- Statistics and predictive modeling

- Economics and finance

- Risk management principles

- Professional actuarial examinations

This actuarial science foundation proved crucial. The field requires passing 7-10 extremely difficult professional exams, and only about 40% of those who start the actuarial path complete all certifications. Towriss’s success in this demanding field indicated the analytical rigor he would later apply to building Group 1001.

Ball State University Connection

Towriss maintains strong ties to Ball State University, serving on the Ball State University Foundation Board. While Indiana University provided his primary education, his relationship with Ball State demonstrates:

- Commitment to Indiana higher education

- Philanthropic engagement with regional institutions

- Networking within Indiana business community

- Giving back to educational institutions that fuel local talent

This educational foundation created the technical expertise necessary to identify opportunities in the complex insurance marketplace that others might miss.

Career Journey: From Actuary to Insurance Mogul

The path from actuarial analyst to creating a multi-billion dollar insurance empire showcases strategic career progression and calculated risk-taking.

Early Career: Building Insurance Expertise

Actuarial Analyst Beginnings

Fresh from Indiana University Bloomington, Towriss entered the insurance industry at the technical level:

- Pricing insurance products based on mortality tables and risk models

- Developing expertise in life insurance and annuity mathematics

- Understanding regulatory requirements across different states

- Building relationships with insurance executives and investors

ING Reinsurance Years

At ING, one of the world’s largest financial institutions, Towriss gained:

- International insurance market exposure

- Understanding of reinsurance—the insurance that insurance companies buy

- Risk transfer mechanisms and capital management

- Experience with billion-dollar portfolios

AEGON Leadership

Rising to Regional Head of Pricing at AEGON demonstrated:

- Management capabilities beyond technical actuarial work

- Strategic thinking about product development

- P&L responsibility for significant business units

- Leadership of teams managing multi-state operations

This corporate experience provided the playbook for what would become Group 1001—understanding how large insurance companies operate revealed where efficiency gains and innovation opportunities existed.

The Entrepreneurial Turn: Creating Group 1001

First Ventures and Strategic Vision

In 2017, after nearly 20 years in corporate insurance, Towriss made the leap to entrepreneurship by founding Group 1001. The initial strategy involved:

- Identifying orphaned or underperforming insurance blocks of business

- Acquiring assets from larger insurers divesting non-core operations

- Applying modern technology to reduce operating costs

- Creating a platform that could acquire multiple insurance entities

Early Acquisitions and Growth

The first few years involved smaller acquisitions that tested the model:

- Purchasing closed blocks of life insurance policies

- Acquiring distribution relationships with financial advisors

- Building technology infrastructure to service policies efficiently

- Establishing regulatory relationships in key states

Building Towards Delaware Life

By 2020, Group 1001 had established credibility and raised capital for the transformative Delaware Life Insurance Company acquisition:

- $375 million purchase price demonstrated access to significant capital

- Overnight transformed Group 1001 from startup to major player

- Provided platform for cross-selling across multiple brands

- Created the foundation for the current $66 billion in assets under management

Leadership Philosophy: Innovation, Integrity, Impact

Towriss’s leadership approach combines several key principles:

Innovation in a Traditional Industry

While insurance is often seen as stodgy and resistant to change, the visionary leader pushed:

- Digital-first customer experiences through Gainbridge

- Streamlined underwriting using data analytics

- Modern marketing approaches including NBA All-Star partnerships

- Technology platforms that make insurance accessible to younger customers

Integrity and Regulatory Compliance

Unlike some insurance entrepreneurs who cut corners, Towriss emphasized:

- Strong regulatory relationships across all 50 states

- Conservative investment strategies protecting policyholder funds

- Transparent communication with regulators and stakeholders

- Building sustainable businesses, not quick flips

Impact Beyond Profits

The business strategist also focused on broader impact:

- Creating employment opportunities across multiple states

- Making insurance products more accessible and affordable

- Partnering with organizations like Cal Ripken Jr. Foundation

- Supporting community initiatives through corporate philanthropy

This three-part philosophy—innovation, integrity, impact—explains how Group 1001 grew so quickly while maintaining regulatory approval and industry credibility.

Personal Life: Wife, Family, and the Boat Crash Controversy

Beyond business success, Dan Towriss’s personal life includes both celebration and controversy.

Family Life: Cassidy Towriss and Marriage

Cassidy Towriss became Dan Towriss wife on October 10, 2020, in what sources describe as an intimate ceremony. The couple maintains a notably private lifestyle despite Dan’s business prominence:

- Few public photos or social media posts about their relationship

- No confirmed information about children or extended family

- Preference for staying out of celebrity and society coverage

- Focus on business and philanthropy over personal publicity

The marriage came during a period of professional success, just months after the Delaware Life acquisition that transformed Group 1001’s trajectory.

The 2019 Boat Crash: Full Story

The most controversial chapter in Towriss’s life occurred on December 31, 2019, in Fort Lauderdale, Florida.

The Incident

According to police reports and court documents:

- Towriss was operating a boat in Fort Lauderdale waters on New Year’s Eve

- The vessel struck a channel marker or another object

- Passengers on board sustained serious injuries

- Emergency services responded to the scene

- Towriss was subsequently charged with operating a vessel while impaired

Legal Consequences

The aftermath involved:

- Criminal charges filed by Florida prosecutors

- Civil lawsuit filed by injured parties seeking $100 million in damages

- Extensive legal proceedings spanning multiple years

- Potential reputational damage to Group 1001 and subsidiary brands

Resolution and Current Status

While complete details remain sealed in some court documents:

- Criminal charges were resolved through legal proceedings

- Civil lawsuit reached undisclosed settlement terms

- No ongoing public legal action related to the incident

- Towriss maintains his business leadership roles despite the controversy

Impact on Reputation

The boat crash created challenges:

- Negative media coverage during a critical growth phase for Group 1001

- Questions from regulators about character and fitness

- Potential concerns from business partners and investors

- Personal and professional stress during legal proceedings

However, the incident didn’t derail his business trajectory—Group 1001 continued growing and making major acquisitions in the years following the crash, suggesting stakeholders separated the personal incident from his business capabilities.

Physical Stats and Personal Details

For those curious about the personal details beyond wealth:

- Age: 55 years old (as of 2025/2026)

- Height: Approximately 5’9″ (175 cm)

- Weight: Around 98 kg (216 lbs)

- Build: Stocky, athletic build suggesting former sports participation

- Appearance: Professional demeanor, typically seen in business attire at industry events

These physical details rarely matter for business analysis but appear frequently in online searches, so we include them for completeness.

Philanthropy and Community Impact

Despite his private nature, Dan Towriss directs significant resources toward charitable causes, particularly focusing on youth development and sports access.

Major Philanthropic Partnerships

Cal Ripken Jr. Foundation

Partnership with baseball legend Cal Ripken Jr.’s foundation focusing on:

- Youth baseball and softball programs in underserved communities

- Character development through sports

- Preventing youth violence through positive activities

- Building fields and facilities in areas lacking sports infrastructure

Group 1001 and Gainbridge have provided substantial funding, helping the foundation reach over 200,000 kids across 22 states.

RISE (Ross Initiative in Sports for Equality)

Supporting social justice in sports through:

- Education programs addressing racism and inequality

- Training for sports organizations on inclusive practices

- Community dialogues bringing together diverse groups

- Leveraging sports as a platform for positive social change

Indy Women in Tech

Addressing gender imbalance in Indiana’s technology sector:

- Scholarship programs for women in STEM fields

- Mentorship connecting women professionals with rising talent

- Advocacy for inclusive hiring practices in tech companies

- Events and networking supporting women’s professional development

Education and Youth Focus

Ball State University Foundation Board

Beyond serving on the board, Towriss has directed resources toward:

- Actuarial science program development

- Business school initiatives

- Student scholarships for Indiana residents

- Career development and internship programs

NBA All-Star Partnerships

Through Gainbridge’s NBA sponsorships:

- Youth basketball clinics in Indianapolis and other cities

- Financial literacy programs tied to sports events

- Scholarship opportunities for student-athletes

- Community events making NBA experiences accessible to underserved youth

Overall Impact Assessment

The philanthropic portfolio reflects several themes:

- Focus on youth development and education

- Leveraging sports as community-building tools

- Supporting Indiana institutions and communities

- Creating pathways to opportunity for underserved populations

While not operating a personal foundation (unlike some billionaires), Towriss directs corporate philanthropy in ways that create measurable community impact, particularly in reaching 200,000+ kids through various sports and education initiatives.

Social Media Presence: Public vs. Private Balance

For a business leader of his stature, Dan Towriss maintains a surprisingly minimal social media footprint.

Platform Activity

- Professional profile highlighting Group 1001 leadership

- Occasional posts about company milestones

- Industry thought leadership on insurance innovation

- Network of insurance professionals and business leaders

- Limited personal account with minimal public posts

- Primarily business-related content when active

- No lifestyle or family content visible to public

- Sporadic posting frequency

- Basic presence, mostly dormant

- Occasional sharing of Group 1001 news

- Limited engagement with content

AllMyLinks

- Central hub connecting various professional profiles

- Contact information for business inquiries

- Links to Group 1001 and subsidiary company websites

The Privacy Strategy

This minimal social media presence reflects:

- Preference for privacy despite public business role

- Focus on business results over personal branding

- Avoiding controversy or unwanted attention

- Professional approach separating business from personal life

In an era where many executives build personal brands through social media, Towriss’s restraint is notable—letting business performance speak rather than cultivating influencer status.

Net Worth Comparison: How Does Dan Towriss Rank?

Understanding his wealth requires context within the insurance industry and among serial entrepreneurs.

Insurance CEO Comparisons

Public Company Insurance CEOs (for comparison):

- Brian Duperreault (former AIG CEO): Net worth estimated $50-100 million primarily from salary/stock

- Evan Greenberg (Chubb CEO): Net worth $150-200 million from decades in industry

- Dan Amos (Aflac CEO): Net worth $150-250 million, including significant company stock holdings

Dan Towriss’s position differs—as founder and majority owner of Group 1001, his wealth is tied to private equity value rather than public company stock, making direct comparison difficult.

Serial Entrepreneur Comparisons

Insurance Entrepreneurs:

- Patrick Ryan (Aon founder): Net worth $6+ billion from building global brokerage

- W.R. Berkley (W.R. Berkley Corporation founder): Net worth $2+ billion from specialty insurance

- George Joseph (Mercury Insurance founder): Net worth $1.8+ billion at peak

Towriss is building toward this tier—if Group 1001 continues its trajectory, he could join the billionaire insurance founder ranks within 5-10 years.

Wealth Trajectory Analysis

What sets Towriss apart:

- Speed of accumulation: Building multi-hundred-million dollar wealth in under 10 years as entrepreneur

- Growth potential: Group 1001 still scaling, suggesting substantial future appreciation

- Diversification: Formula 1 venture adds completely new wealth creation avenue

- Age advantage: At 55, he has 10-20 years to compound wealth further

Many insurance billionaires built their fortunes over 30-40 years; Towriss’s accelerated path reflects both the advantages of modern technology in insurance and his strategic acquisition approach.

2026 Projections and Future Outlook

Looking forward, multiple factors will influence Dan Towriss net worth 2025 and beyond.

Analyst Predictions

Some financial analysts project Dan Towriss could reach $4 billion net worth by 2028, though this depends on several assumptions:

- Group 1001 achieving an IPO or major sale event

- Continued growth in assets under management

- Successful scaling of Gainbridge’s digital platform

- Multiple expansion as company matures

- Formula 1 venture creating substantial separate value

Conservative scenario: $800 million to $1.2 billion by 2028 Base case scenario: $1.5 billion to $2.5 billion by 2028 Optimistic scenario: $3 billion to $4 billion by 2028

Formula 1 Venture Impact

The TWG Motorsports and Cadillac Formula One team investment could:

- Downside scenario: Consume $500 million over five years with limited return, becoming a vanity project that reduces net worth

- Base scenario: Break even over time while providing brand exposure and personal satisfaction

- Upside scenario: Create $500 million to $1 billion in value if F1 in America continues explosive growth and team achieves competitive success

Group 1001 Expansion Plans

The insurance empire continues pursuing growth:

- Additional acquisitions of insurance blocks and companies

- Geographic expansion into underserved markets

- Product innovation in annuities and life insurance

- Technology investments improving efficiency and customer experience

- Potential international expansion beyond U.S. market

Each successful acquisition and organic growth point increases the company valuation—and Towriss’s majority stake value.

Market Position Strengthening

Group 1001 benefits from several favorable trends:

- Baby boomer retirement creating enormous annuity demand

- Younger consumers embracing digital insurance products like Gainbridge

- Ongoing consolidation in insurance industry creating acquisition opportunities

- Low interest rates making insurance returns attractive to consumers

- Regulatory stability in core markets

These factors suggest the business strategist is well-positioned for continued wealth accumulation.

Frequently Asked Questions

Is Dan Towriss a billionaire?

Dan Towriss likely isn’t a billionaire yet based on liquid net worth, though his stake in Group 1001 could be worth $1–1.5 billion on paper.

What is Dan Towriss’s salary as CEO of Group 1001?

Dan Towriss’s salary is estimated at $5–7 million base, with total compensation of $18–33 million annually including bonuses and equity.

How did Dan Towriss make his money?

He made his fortune by founding Group 1001 in 2017, acquiring insurance companies like Delaware Life, and building a $66 billion asset management empire.

What happened in the Dan Towriss boat crash?

On December 31, 2019, he was involved in a Fort Lauderdale boat accident that resulted in injuries and a $100 million lawsuit.

Is Dan Towriss still married to Cassidy Towriss?

Yes. Dan and Cassidy Towriss married on October 10, 2020, and remain married with a notably private personal life.

What companies does Dan Towriss own?

He owns 60–70% of Group 1001, which includes Delaware Life, Gainbridge, Paragon Life, Clear Spring Life, and Guggenheim Life subsidiaries.

How much is Group 1001 worth?

Group 1001 is valued at approximately $5–7 billion with $66 billion in assets under management across its insurance subsidiaries.

What is Dan Towriss’s role in Formula 1?

In February 2025, he became CEO of TWG Motorsports, leading the new Cadillac Formula One team entering competition in 2026.

Conclusion

Dan Towriss net worth represents entrepreneurial success in insurance, ranging from $500 million to $1.5 billion. While not definitively a billionaire, his Group 1001 empire and Formula 1 ventures position him for continued wealth growth toward that milestone.